Creative Direction: Colin Doerffler at CD HQ and Caroline a.k.a. Yuzu. for Dot Dot Dot.

Surely this can’t last?

That’s what we wondered when Miu Miu, a brand founded over thirty years ago, claimed the top spot on the Lyst Index this quarter, officially crowned the world’s hottest fashion label.

The timing made it even more remarkable: across the luxury sector, giants like Louis Vuitton and Gucci are feeling the chill as consumers pull back from discretionary splurges, macroeconomic headwinds squeeze demand, and post-pandemic novelty wears thin.

Part of that comes from an uncanny cultural product pulse, part of it comes from community-building and casting precision.

Everything we’re seeing says the brand is still climbing. Which is why it feels strange (we apologise in advance) to point out that our Brand mRNA data suggests the very “brand protein” driving this ascent might already be nearing its peak.

But inevitability isn’t the story here. Because the same data that spots fragility also shows where strength is building, the quieter cultural proteins that, if activated now, could keep Miu Miu at the top long after the hype cycle shifts.

DUM DUM DUM. Aren’t you intrigued to read on?

[SIDE NOTE: Curious to go deeper into this report or others? Book an intro call with Early Studies here.]

But Before We Get Into It…

…let’s explain why we’re even doing this.

Tracking a brand’s health used to mean tracking its Brand DNA, the fixed internal truths that defined who it was and kept it consistent. That worked when luxury moved in decades-long arcs. But the speed of now? Brands are built and broken in the space between a TikTok trend and a group chat. Influence is ambient. Authority is unpredictable. Meaning is elastic. You follow?

In biology, DNA is the blueprint, but mRNA (messenger RNA) is what makes things happen. It reads the DNA, figures out what the body needs in real time, and sends flexible instructions to build the right proteins. It’s adaptive by design, turning static code into a living response.

That’s the metaphor. Brand mRNA is our way of translating a brand’s fixed identity into real-time cultural action.

It was a brainchild by our partners at Early Studies — the cultural signals intelligence company founded by ex-Google and Vice strategists who are rethinking research to match culture’s pace. Using their proprietary Future Perfect method, we asked 1,500 representative luxury consumers in the US, UK, and the UAE not just what they think, but what their fashion-focused friends would say.

It’s a crucial distinction, because it bypasses self-deception and virtue signalling, measuring and revealing the real perceptions circulating in culture. Each data point tracks changes over time that our respondents are asked to predict: five years ago (2020), today (2025), and where those signals are expected to be in three years’ time (2028).

We map those perceptions into “proteins” (some growing, some flatlining, some declining) so we can see which are worth doubling down on and which need replacing before the brand gets… sick.

Together, we’ve also brought in Mata, a pioneering design software studio, to develop a bespoke data visualization system that creates Brand mRNA strands and a portal where clients can access, analyse, and export data relevant to their projects.

[Respond to this email about this to hear more].

This series is our monthly check-up on the cultural health of the world’s most buzzed-about fashion brands. Sometimes we’ll find the signs of a long reign. Sometimes, like with Miu Miu, we’ll see the beginnings of fragility in the middle of a high.

Case Study 002: Miu Miu, Sweet Rebellion at Scale

When Miu Miu launched in 1993, it wasn’t designed to carry Prada Group’s fortunes. It was Miuccia Prada’s playground, the place for impulses that wouldn’t fit within Prada’s intellectual minimalism. Named after her childhood nickname, it was a study in contrasts: rebellious yet romantic, prim yet provocative.

For much of the next two decades, Miu Miu lived in that liminal space. It had runway moments that thrilled the fashion press, campaigns that flirted with provocation, and celebrity fans who treated it like a badge of insider status. But it lacked a long-term cultural engine. There were certainly flickers like the cult following for its 2010 glitter boots or the playful sixties-inspired tailoring of 2015, but these moments came and went without transforming the brand’s commercial gravity radically.

Byyyyyyyyyyyy the late 2010s, Miu Miu was still an acquired taste: respected, even loved in small circles, but often overshadowed by Prada’s sharper commercial instincts. The collections were eclectic, sometimes brilliant, but the brand didn’t have a sustained storyline the wider luxury audience could hold onto. It certainly wasn’t a luxury leader.

Then, in the early 2020s, something clicked.

First, an uncanny cultural product instinct. Miu Miu started releasing pieces that just landed. Viral micro-minis, logoed workwear, sailor shoes, bow hairclips, branded underwear. Each timed to hit the exact intersection of cultural mood and product desire. The micro-mini skirt of 2022 was the peak: Y2K nostalgia, post-pandemic liberation, and TikTok’s hunger for instantly recognisable silhouettes in one garment. Even the quiet menswear relaunch felt calculated without being forced.

Second, wearability. Despite their visual punch, these hero products worked in real wardrobes, styled high or low, fitting seamlessly into the Instagram/TikTok aesthetic vocabulary.

Third, timing and exits. Miu Miu retired product stories before they went stale, pivoting to new ones while the old still had heat, avoiding the overexposure trap that kills luxury desirability and is easier said then done.

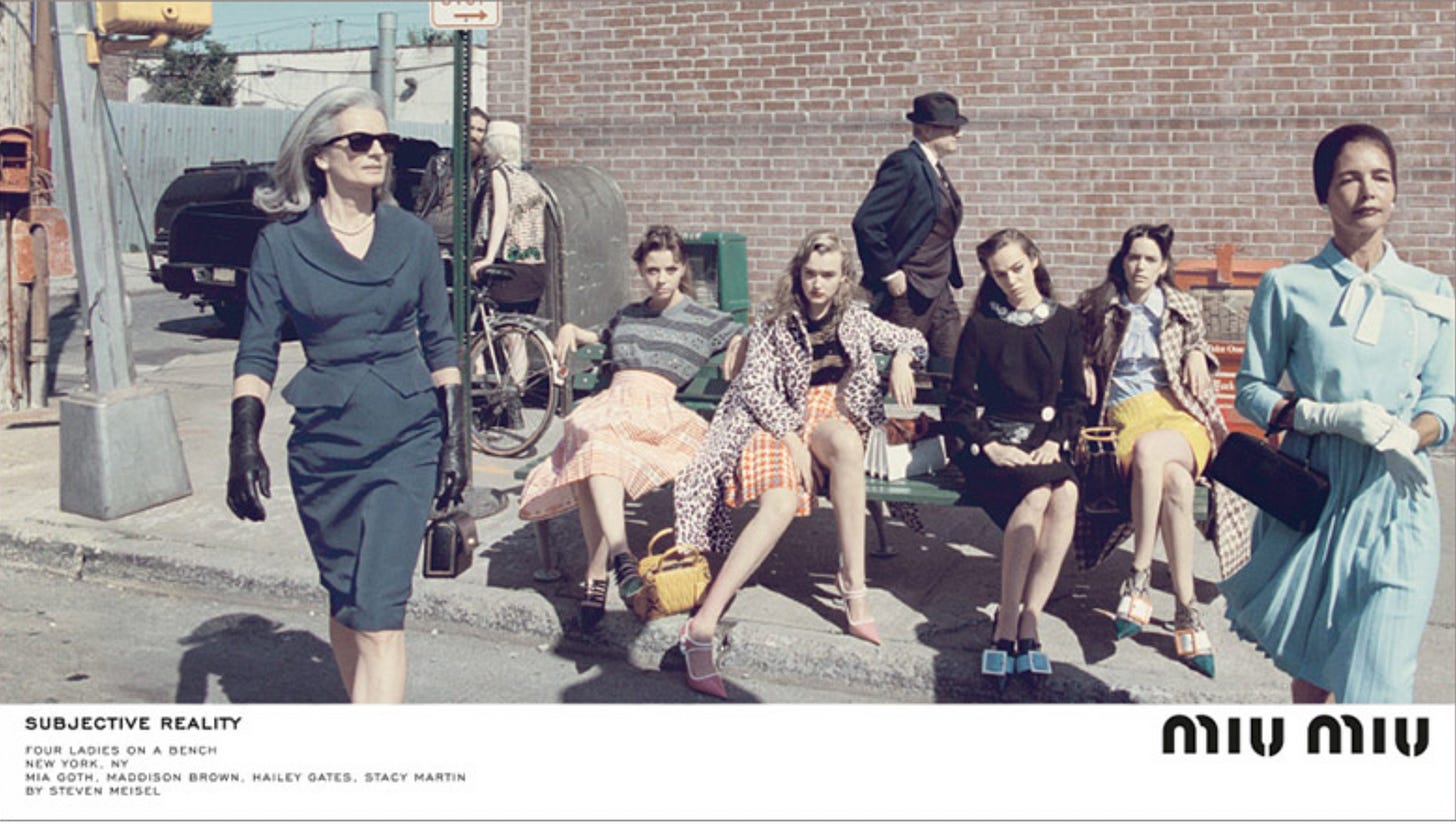

Fourth, and most importantly, casting as cultural architecture. Sydney Sweeney’s softly-offbeat glamor, Emma Corrin’s cerebral grace, Kylie Jenner’s algorithmic reach, Lorde’s indie heft, Cara Delevingne’s chaotic magnetism, Mia Goth’s cult mystique, each one distinct, but together creating a singular mood.

Beneath them, the deep insider credibility of Zaya Wade, Cortesia Star, and Ethel Cain, figures whose presence says “if you know, you know” to the right cultural circles. It was a deliberately tiered ecosystem, where celebrity reach met subcultural authority, and every tier was tied together through recurring appearances at shows, events, and campaigns. The result was a universe that felt at once aspirational and accessible. Something that you feel you too could reach. Miu Miu understood you.

Finally, internet-native literacy. Miu Miu mastered the visual formats that travel at speed, crisp hero shots, short-form video, and just enough quirk to be memed while staying aspirational.

Together the result was a three-year leap from Prada’s quirky sideline to one of the most recognisable cultural forces in luxury fashion.

When Cool Starts To Crack

Commercially, the trajectory has been extraordinary. In just three years, Miu Miu has shifted from Prada’s eccentric sideline to one of its core growth engines, now responsible for roughly a quarter of the group’s total sales. It’s a textbook example of relevance converted into revenue. And not even through heritage mining or archive worship, but through products, casting, and cultural timing engineered in real time.

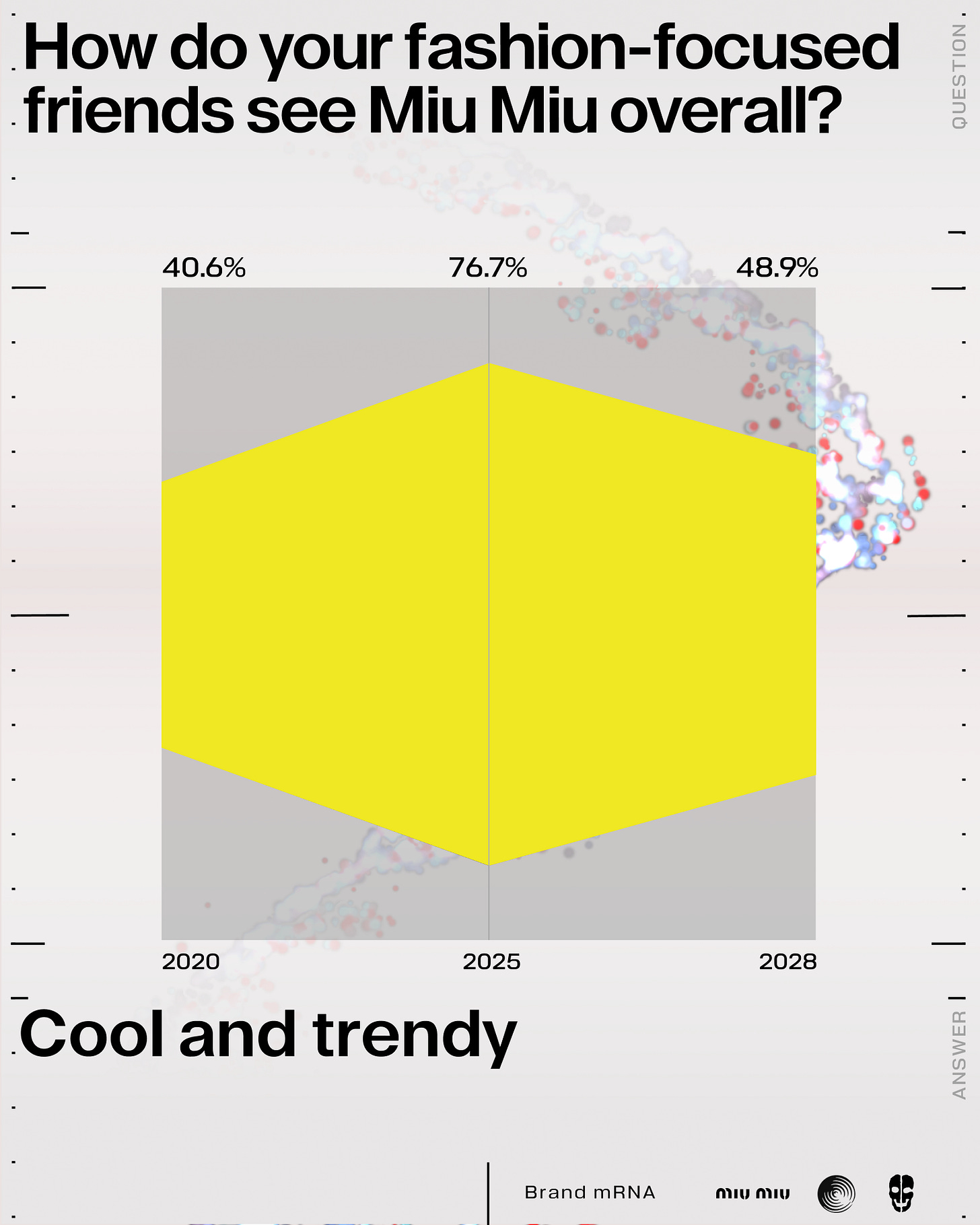

Our Brand mRNA data confirms the story so far. When asked what the social circles of our respondents believe they’re buying when they buy Miu Miu, 76.7% of them chose “cool and trendy,” up from just 40.6% five years ago. That’s a 36-point leap and an acceleration most luxury brands never see in a decade. The same shift shows up in design perception: “playful, youthful energy with a distinctive edge” now leads at 69%, up from 52% five years ago. The signal is clear: the machine is working.

But here’s the rub. Those same “cool and trendy” proteins are showing early signs of fatigue. Our interviewed audience’s projections show that number sliding to 48.9% by 2028. The decline doesn’t erase the gains, but it does suggest the story is running out of new verses. And in a category where trend energy is inherently perishable, the risk isn’t slow erosion but a sudden drop-off.

This is the paradox of Miu Miu’s rise: the very quality that supercharged its growth is also the most vulnerable to overexposure. In mRNA terms: the dominant strand has done its job. But the cultural environment is shifting, and the brand will need to code new proteins to stay resonant. Here’s where the signals point.

Miu Miu Future mRNA Decoded

From Observers to Co-Participants

If there’s one shift that could buffer Miu Miu against trend fatigue, it’s deepening participation.

When we asked respondents how their fashion-focused friends see Miu Miu today, “building fashion community” scored 54.3% in 2020, rising slightly to 55.7% in 2025, but projected to dip to 52.6% by 2028. That flatlining signal contrasts sharply with the growing appetite for active involvement: in 2020, just 6.4% said their circles saw Miu Miu as “collaborating with customers on ideas”. By 2025, that figure reaches 9.7%, and is projected to nearly double again to 19.2% by 2028.

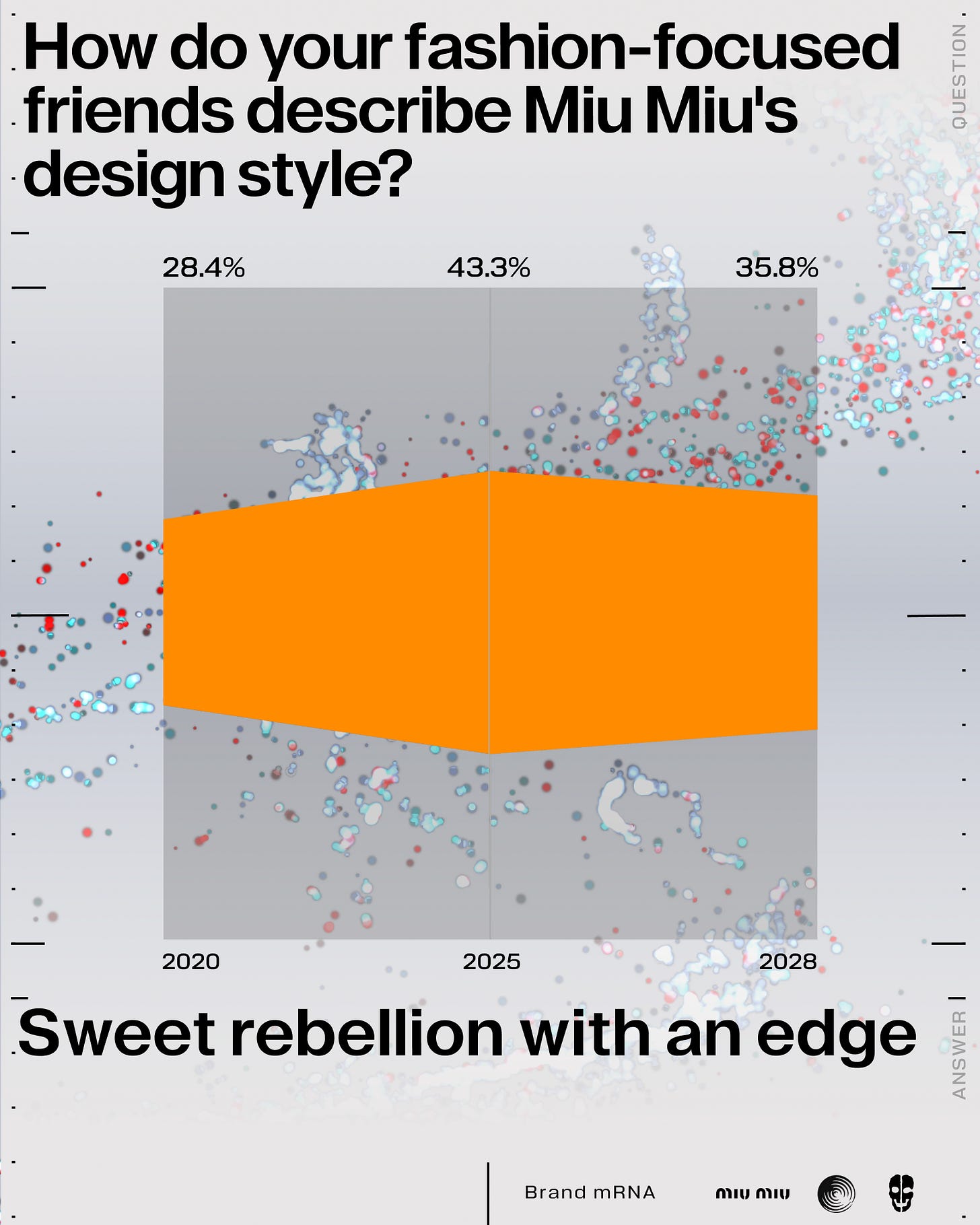

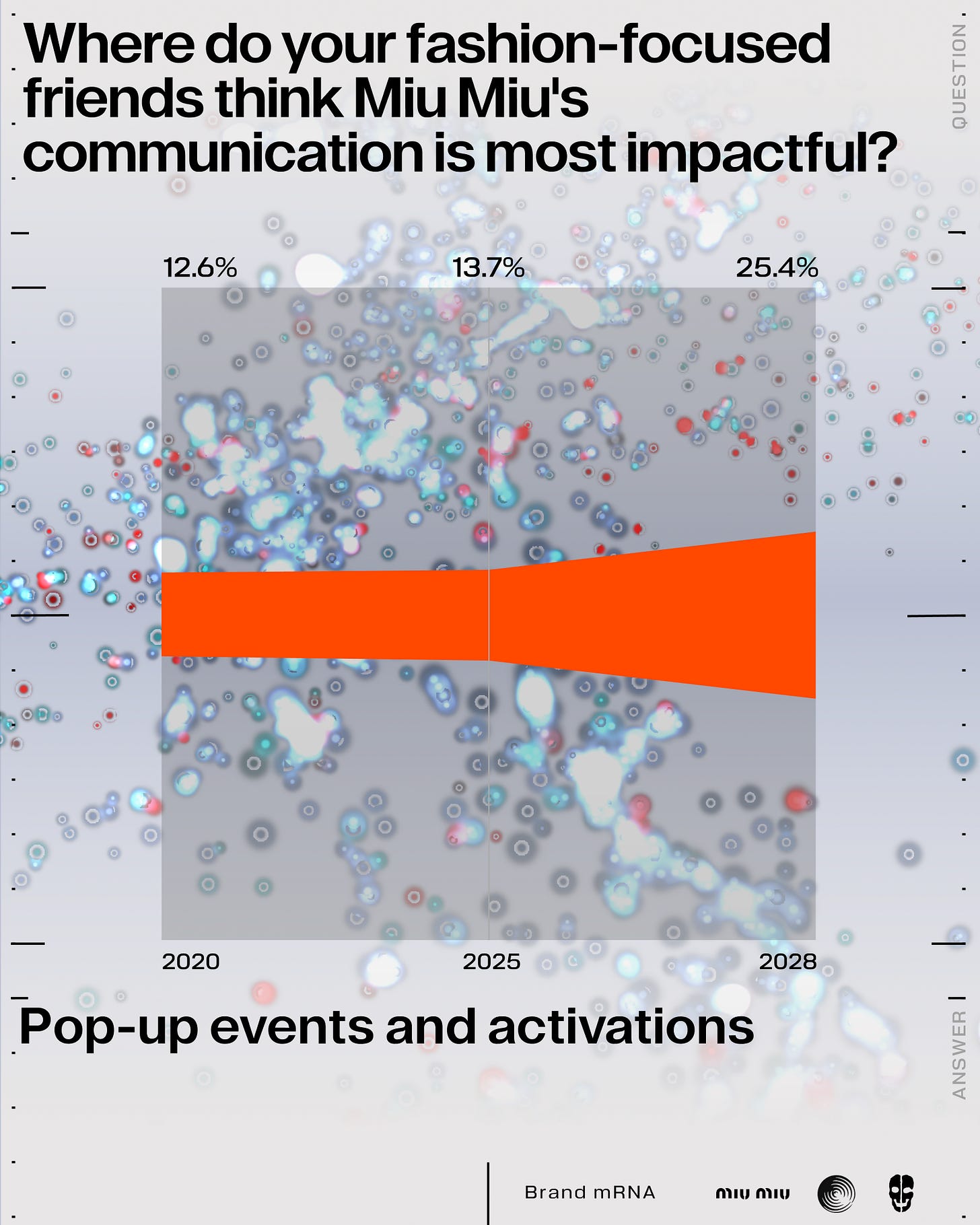

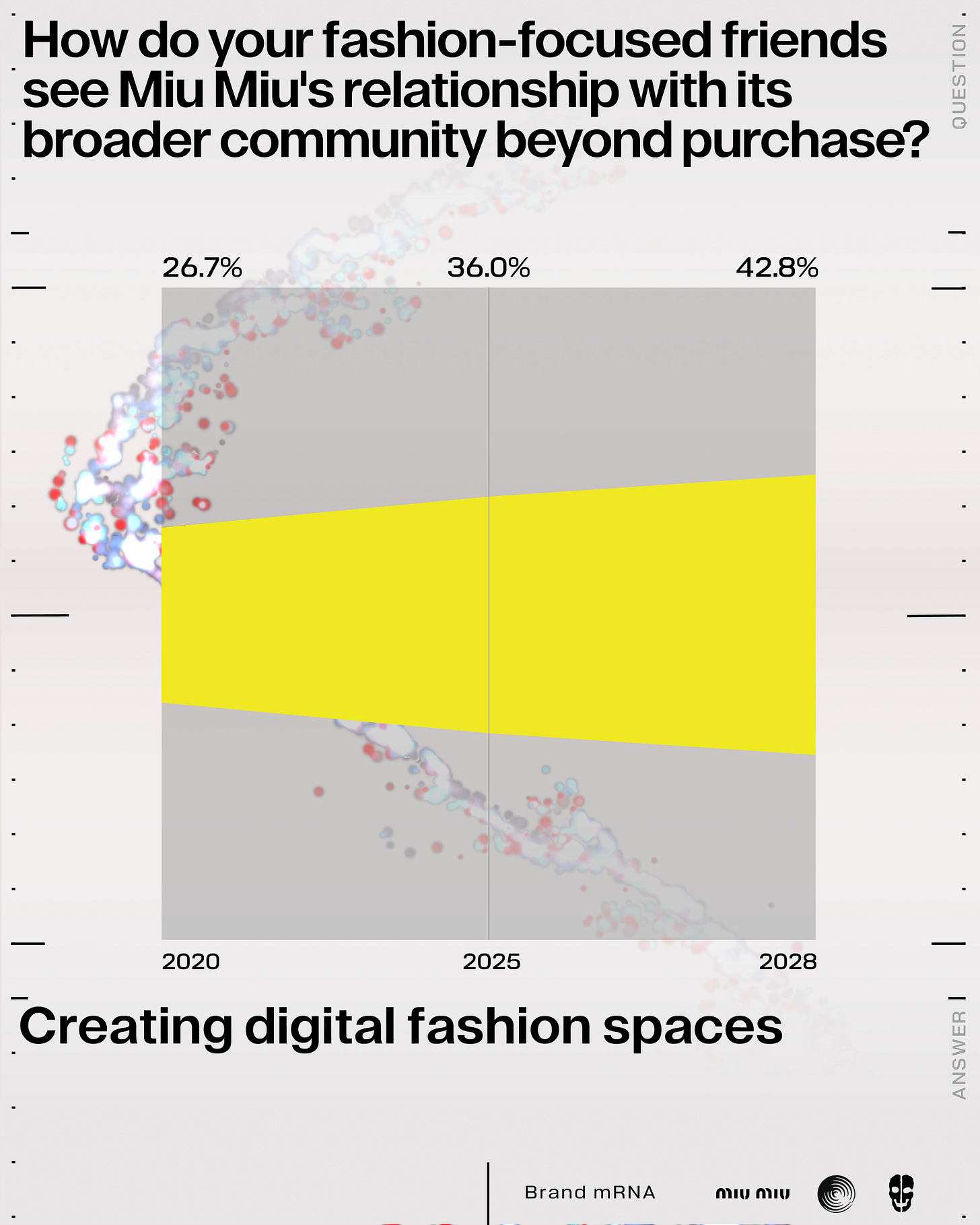

The desire for more immersive touchpoints is just as clear when we look at specific formats. People wanting the brand to “Create digital fashion spaces” rises from 26.7% in 2020 to 36.0% today, with a projected 42.8% by 2028. “Pop-up events and activations” see an even steeper jump ahead — from 12.6% in 2020 to 13.7% now, but nearly doubling to 25.4% in the next three years. And “experimenting with digital platforms” climbed from 28.4% in 2020 to 41.7% today, with further growth to 46.6% expected by 2028.

The seeds are already visible (livestreaming runway shows, the book-giveaway summer pop-ups) but the scale and selectivity will determine whether this protein matures into a lasting advantage. Miu Miu has excelled at projecting the image of a vibrant, insider community; the next step is giving people tangible pathways to enter it without diluting its allure.

Balancing the Style Genome

Right now, Miu Miu’s perceived design style is dominated by “playful, youthful energy with a distinctive edge” (52% in 2020, rising to 69% today, but projected to fall sharply to 42.4% by 2028). In mRNA terms, that dominant strand is showing signs of overexpression.

Miu Miu has proven it can ignite a cultural moment. The challenge now is to design a more complex style genome: one where trend, craft, cultural depth, and inclusivity work in tandem to keep the brand irresistible long after the initial spike fades.

Proteins respondents believe will drive desire among their fashionable friends:

Perfect craftsmanship details: 21.9% in 2020, 27.6% today, projected to reach 33.7% by 2028. It could serve as a timeless anchor, balancing the volatility of trend-led appeal and signalling depth to discerning customers.

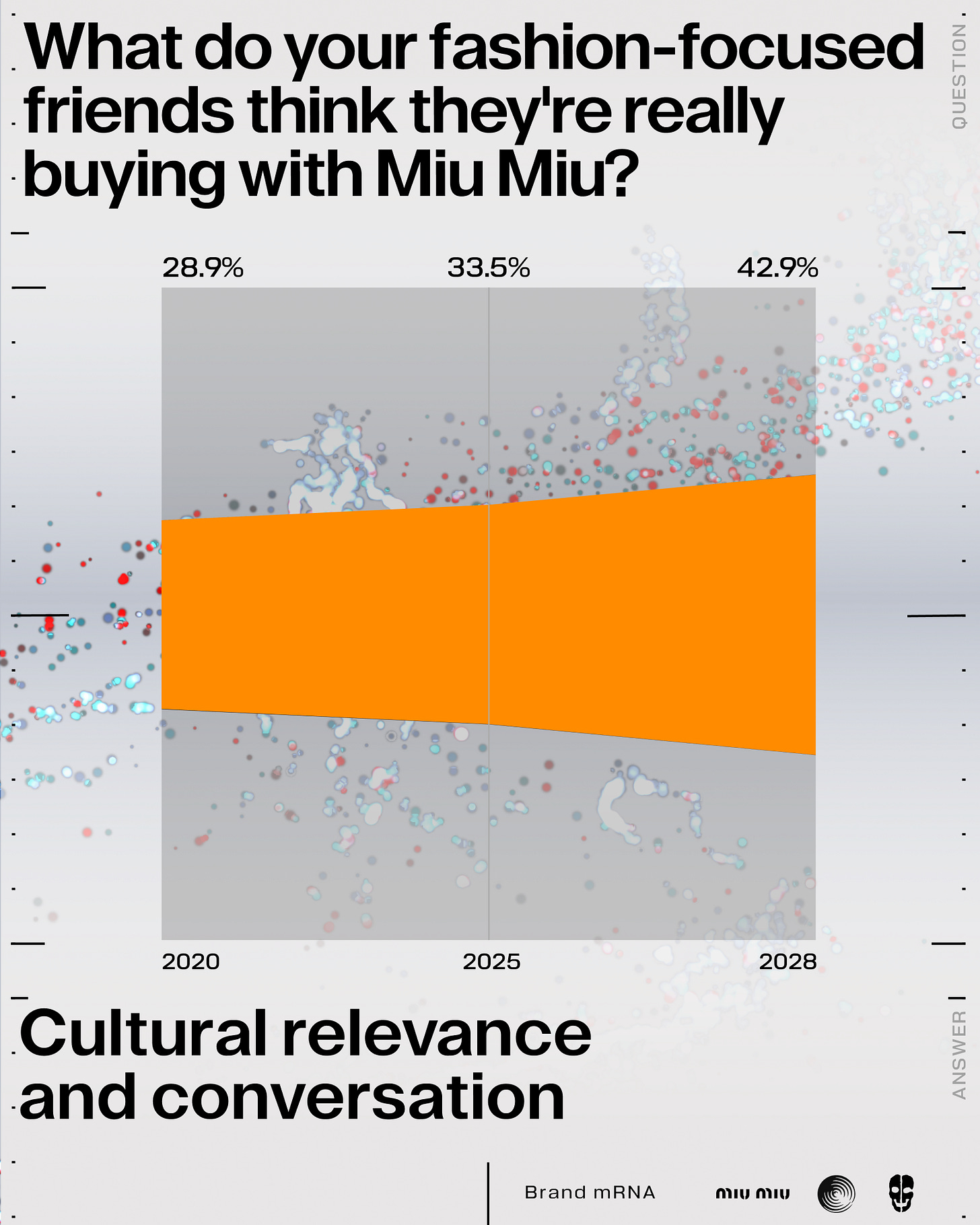

Increase cultural relevance and conversation: 28.6% in 2020, 33.5% today, climbing to 42.9% by 2028. It offers a route to sharpen engagement with contemporary issues beyond surface-level aesthetics, creating emotional as well as visual resonance.

Accessible luxury for everyone: 24.6% in 2020, 31.1% today, projected to 36.6%. It can be reframed so inclusivity becomes part of Miu Miu’s prestige equation, amplifying reach without eroding exclusivity.

Cultural Authority Across Multiple Channels

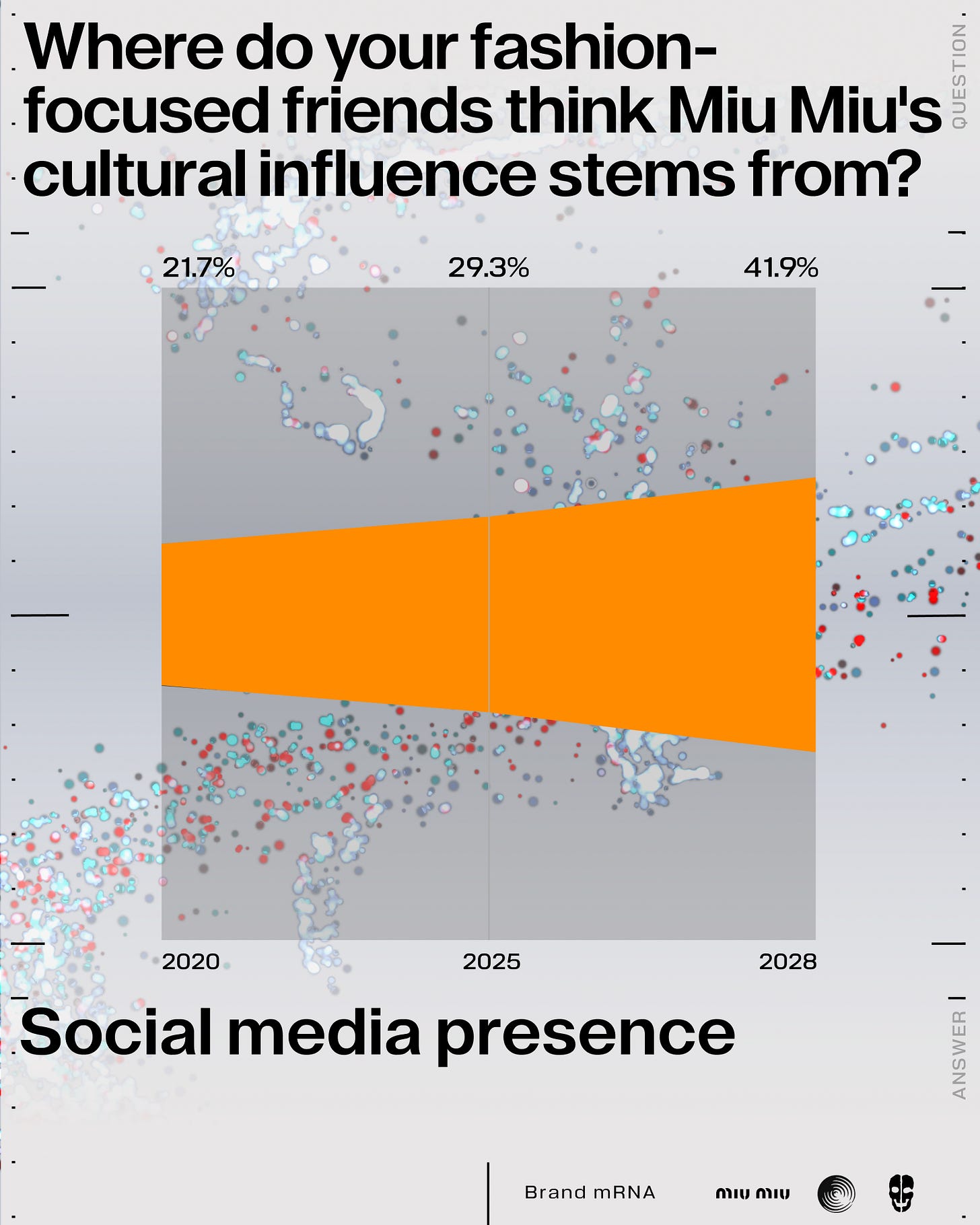

When we asked where fashion-focused friends believe Miu Miu’s cultural influence comes from, the biggest projected growth isn’t the runway but social media presence (29.3% in 2020 to 41.9% in 2025, holding into 2028) and street style & influencers (47.5% in 2020 to 53.8% by 2028).

This marks a clear shift from top-down spectacle to peer-to-peer visibility that’s been going on for the past decade, and it’s notable because the wider market is showing influencer fatigue. While many brands are moving back to blockbuster celebrity moments, Miu Miu could win by staying the course with credible niche figures, swerving right just as the rest go left.

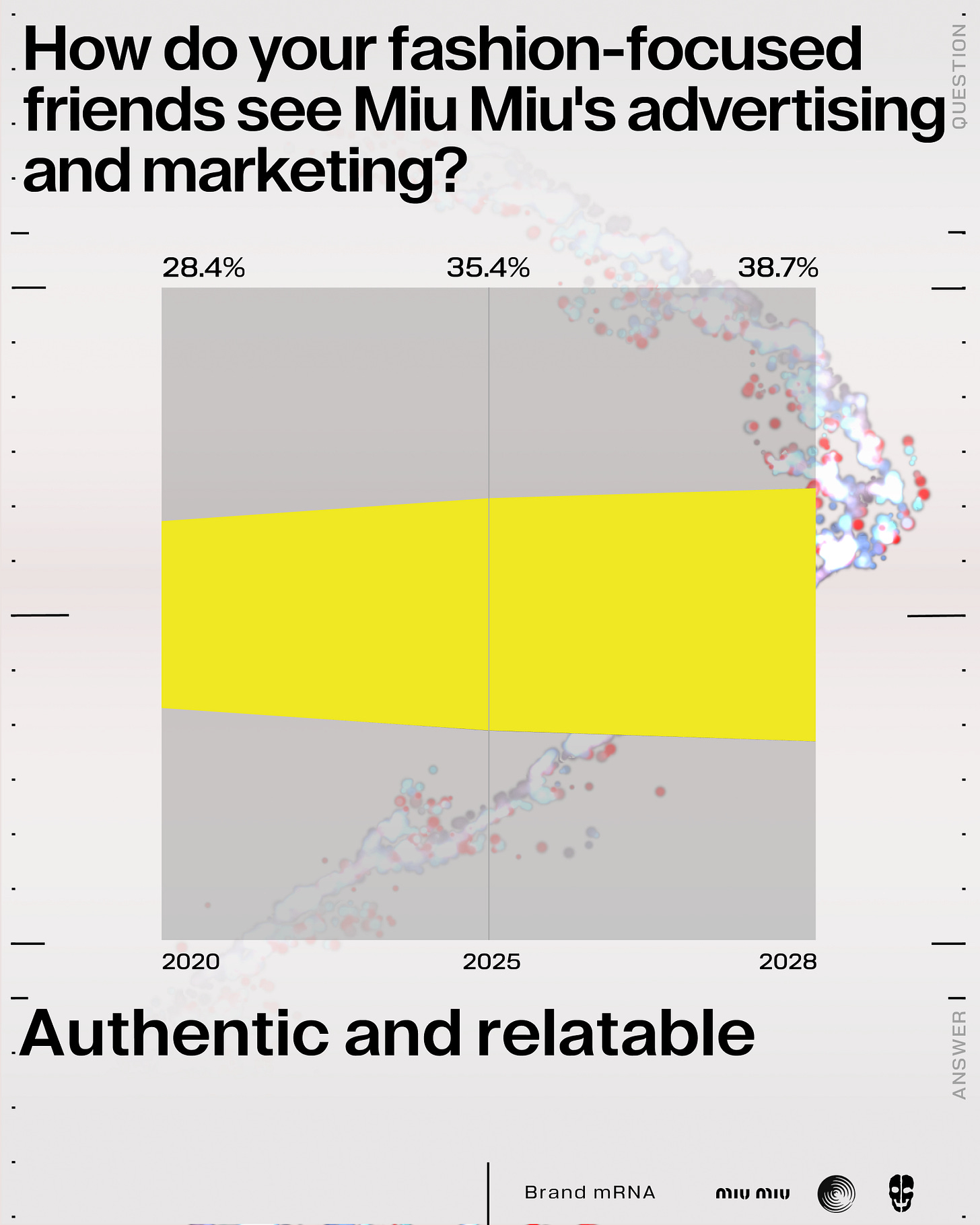

In addition, in advertising and marketing, the protein “authentic and relatable” is climbing steadily (28.4% in 2020 to 35.4% today to 38.7% by 2028), showing that cultural authority isn’t just about who wears the brand, but how it communicates in tone and execution matter.

What this means:

Brand-controlled channels: Miu Miu’s own social platforms should behave less like a catalogue and more like a cultural channel that’s episodic, unpredictable, binge-worthy. Its talent ecosystem should act as an ensemble cast, with serialized arcs, crossovers, and micro-storylines that sustain attention between runway spikes, all delivered in a tone that feels authentic and relatable.

Non-controlled channels: Influence now travels sideways. Miu Miu should seed moments designed to be captured, remixed, and reinterpreted by others (from street photography to artist collaborations) ensuring credibility in spaces the brand doesn’t directly own.

But you know, in the end what do we know?