At Loewe, What Comes After Craft?

Introducing Brand mRNA: A new chapter in strategic brand intelligence.

Creative Direction video: Colin Doerffler at CD HQ and Sam Todd.

Back in March I got a text from Alfred.

“Morning Chris, we have a product concept so strong, I’m feeling confident enough to pitch it on WhatsApp! Sit tight.”

In a slew of messages he introduced the concept of Brand mRNA. There were image references, case study examples, mock up graphs, a reference to Jurassic Park. But that’s between us for now.

“We’ve been thinking about the control idea you had on how [brands] adapt to culture.”

That idea came out of a conversation Alfred’s business partner Sam and I had a few weeks prior over some martinis in London’s Soho. Here we were talking about how cool it would be if we could better understand what actually drives customer desirability, authority, and overall perception for brands.

Is it all the big marketing things brands do and throw millions of dollars at a year or is it increasingly through channels that brands don’t control like word-of-mouth, organic media coverage, digital amplification?

If so, what is becoming more important in terms of the perception of customers?

Now, this conversation wasn’t by chance. Alfred and Sam (ex Google and Vice) founded Early Studies a bit over a year ago. The next-generation “cultural signals intelligence company” sets out to redefine what quantitative research looks like, through the questions they ask, who they ask them to, and how they analyze it all to make it feel more human, and actually useful. It just felt fresher. No wonder On Running, Nike, Dolce & Gabbana and more already work with them.

So together we had a belief we could test things out.

[Curious to go deeper? Book an intro call with Early Studies here.]

Enter: Brand mRNA

Now back to Brand mRNA. What even is that?

To explain it, we looked at biology. DNA holds the blueprint, the essential identity. But mRNA (messenger RNA) is what makes things happen. It reads the DNA, interprets the needs of the body in the moment, and sends out flexible instructions to build the right proteins. It’s adaptive by design. It turns static code into a living response. That’s where we saw the branding metaphor click.

For decades, brand strategy has been anchored in Brand DNA, fixed internal truths meant to drive consistency and control. And it worked. It created alignment, recognizability, and scale. But it wasn’t built for speed. Or cultural feedback loops. Or the weirdness of now.

Today, brands are shaped by memes, moods, micro-trends, FYPs, and group chats. Influence is ambient. Authority is unpredictable. Meaning is elastic. Brand identity alone isn’t enough. Brands need identity that moves. That listens. That adjusts.

They need what mRNA provides in biology: a way to translate core identity into real-time cultural action.

Methodology Rethought

Brand mRNA is our way of making that real. It’s a methodology and now, a monthly research series here on Dot Dot Dot that maps how brands are actually perceived at various points in time and contexts.

We asked representative luxury consumer audiences in US, UK, and China and created a global average. Using Early Studies' proprietary Future Perfect method, combining Social Circle Surveying and the Triple Tense Technique, we asked people to estimate what other luxury consumers they know think right now, how they believe it was different 5 years ago and to predict what will change in the next 3 years. Bypassing self-deception and social desirability bias, whilst accessing people's manifestation.

In sum, we approached them by asking them:

What did this brand mean to you before?

How does it show up for you now?

And what do you want it to become?

We then translate those signals into spectrums to understand not just where brands stand, but where they need to shift.Turning your Brand DNA into action, just like mRNA does.

Together, we’ve worked with Mata, a pioneering design software studio to develop a bespoke data visualization system to create Brand mRNA strands and a portal where clients can access, analyse and export data relevant to their projects.

Respond to this email if you want to hear more.

There’s no better brand to kick off with than Loewe.

Case Study 001: Loewe, Craft as a Cultural Engine

When Jonathan Anderson was appointed creative director of Loewe in September 2013, he was just 29. At the time, he was known primarily for his namesake label J.W. Anderson. A promising, if still emerging, design voice. LVMH’s appointment was bold, and it came with a clear mandate: reinvent a sleepy heritage brand that had fallen off the radar for most of the luxury world.

And oh, did he rise to the occasion.

Anderson rebuilt Loewe from the inside out. Digging deep, he reached into Loewe’s buried essence — its identity as a Spanish leather goods house founded in 1846 — and used that heritage to power a completely new brand proposition. Not just luxury or trend, but contemporary, creative craft. Human, tactile, rigorous, exceptional craft.

Over the span of roughly a decade , Loewe became a masterclass in consistent, craft-first storytelling. Every external expression and customer touchpoint became about craft, craft, craft.

In product, Anderson treated design like architecture. Bags and garments were engineered. The Puzzle bag, introduced in 2015, was the first entirely new handbag silhouette under his tenure. Its origami-like form required over 500 individual steps to assemble, a quiet marvel of geometric construction that helped usher in the era of quiet luxury. And as it found its way into the hands of Zendaya, Timothée Chalamet, Taylor Russell, and Beyoncé, the bag became a kind of shorthand for knowingness.

But the Puzzle was only a starting point. Loewe began releasing capsule collections that carried the craft story forward, season by season, medium by medium. Handwoven Galician blankets. Japanese indigo-dyed fabrics. Even accessories like candles, T-shirts, and keychains were treated with reverence, tied into broader seasonal themes that honored material, form, and the human hand.

In store, that philosophy was made tangible. Loewe’s boutiques, shop-in-shops at wholesale partner, and pop ups became shrines to texture and tactility. Furniture was commissioned from contemporary artisans. Displays were built from hand-carved oak, glazed ceramics, and forged iron. The Omotesando store in Tokyo featured a spiraling staircase sculpted by Japanese craftsmen, while the Casa Loewe flagships in Madrid, London, and Seoul blurred the line between gallery and retail.

Casting followed suit. Campaigns featured actors, yes, Josh O’Connor, Taylor Russell, Maggie Smith, but also choreographers, poets, athletes, and octogenarian artisans. Not just Loewe people. Craft people. People with process and rigor. It reframed celebrity not around fame, but around creative excellence. Ahead of its time in terms of its consistency in messaging this.

The storytelling extended across every channel. Retail windows became seasonal installations. Social feeds pulsed with behind-the-scenes “how it’s made” content. Fashion shows became immersive environments for artistic collaboration. And initiatives like the Loewe Craft Prize and Salone del Mobile exhibitions cemented the brand’s commitment to craft as more than aesthetic. Craft, in Anderson’s Loewe, became not just a message but the medium. The method. The ecosystem.

That uncompromising focus worked.

Brand DNA That Built Billions

Loewe’s annual revenue rose from approximately €230 million in 2014 to between €1.5 and €2 billion in 2024 (according to Bernstein analyst Luca Solca). In the first quarter of 2025, Loewe topped the Lyst Index as the hottest brand in the world. And Anderson’s final Spring/Summer 2025 show was met with a standing ovation by the industry’s inner circle including Sarah Burton, Pharrell, Pieter Mulier, Nicolas Di Felice, as well as LVMH boss Bernard Arnault himself.

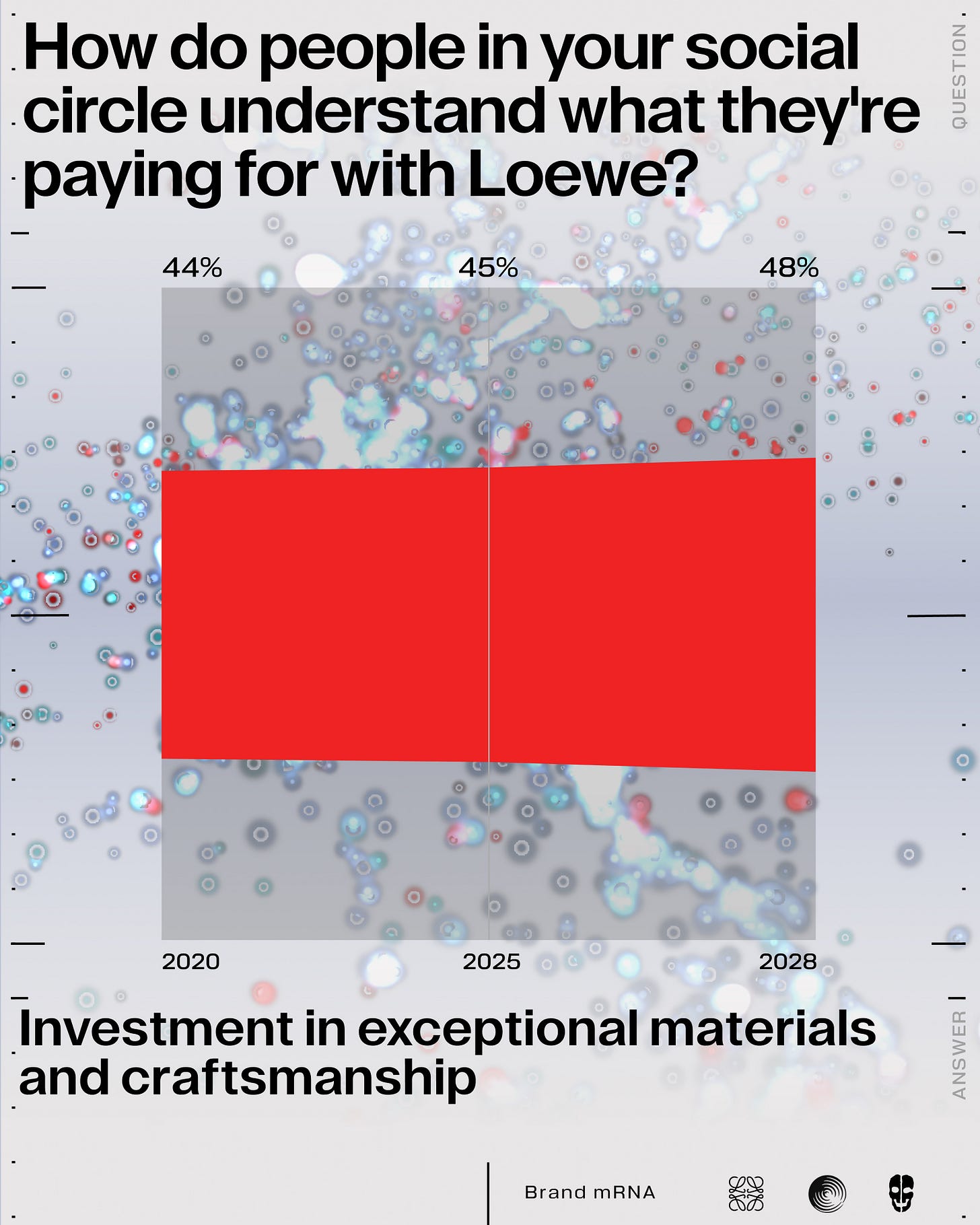

According to our Brand mRNA survey on Loewe, when asked what people in their social circles believe they’re paying for when buying Loewe,the dominant signal wasn’t history. It was craft (surprise!).

When we asked people what their social circles believe they’re paying for when they buy Loewe, 45% pointed to “an investment in exceptional materials and craftsmanship.” That number has climbed over the past five years and is projected to keep rising. Meanwhile, only 38% chose “connection to heritage and historical significance,” a figure that’s remained flat.

In a moment where most luxury brands lean heavily on their archives Loewe chose a different path. It didn’t trade on memory but made the process the point. That distinction made the message land, and the culture picked it up.

That perception even extended to the visual language.

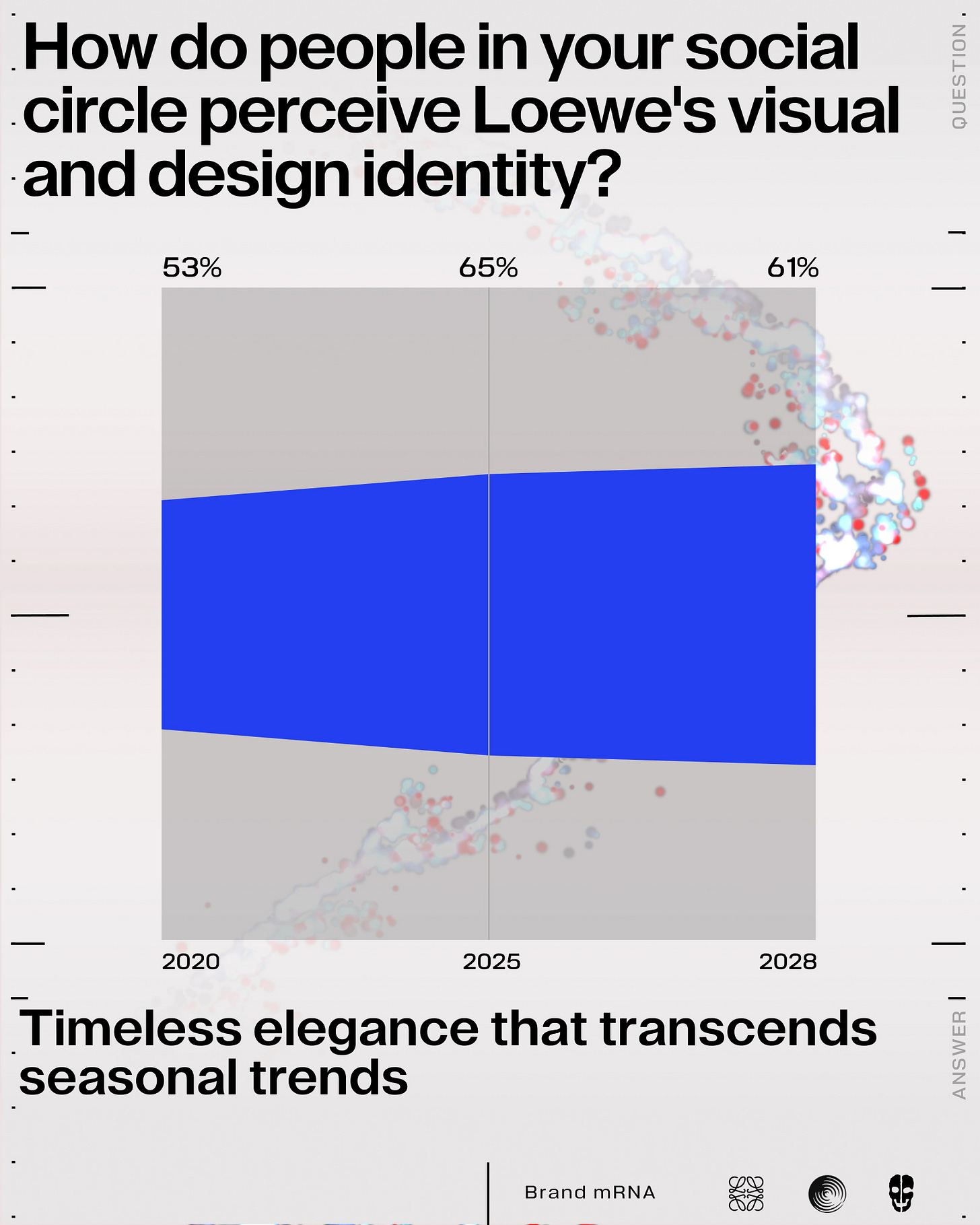

When asked “How do people in your social circle perceive Loewe’s visual and design identity?” the top response was “Timeless elegance that transcends seasonal trends”, cited by 65% of people currently, up from 53% five years ago. Another testament to its immunity to the trend cycle brands often live and die by.

Loewe’s Future mRNA Decoded

Now that’s Brand DNA done well. Anderson clearly codified it by anchoring every expression to one idea.

But here’s where it gets interesting.

In March 2025, Anderson announced his departure. A week later, Jack McCollough and Lazaro Hernandez (the founders of Proenza Schouler) were named his successors. Their first collection is on the horizon. And with that, Loewe enters a new phase.

Because as our Brand mRNA data shows, what worked to build the brand may not be enough to evolve it. Looking at the past five years and projecting into the next three, we see the craft message landed, but we also see that the next chapter won’t be written by message control alone.

Craft still matters, but now the signals suggest Loewe needs to loosen its grip. Audiences want more co-creation, cultural openness, regional resonance, and unexpected access points. They want input.

In mRNA terms: the DNA is clear. But the environment has changed. And for the brand to keep building relevance, it needs to produce new proteins, new expressions that respond to cultural shifts without mutating the core. In other words: let go, in a controlled way. And that’s easier said than done.

What built Loewe’s authority over the past decade won’t be enough in the decade ahead.

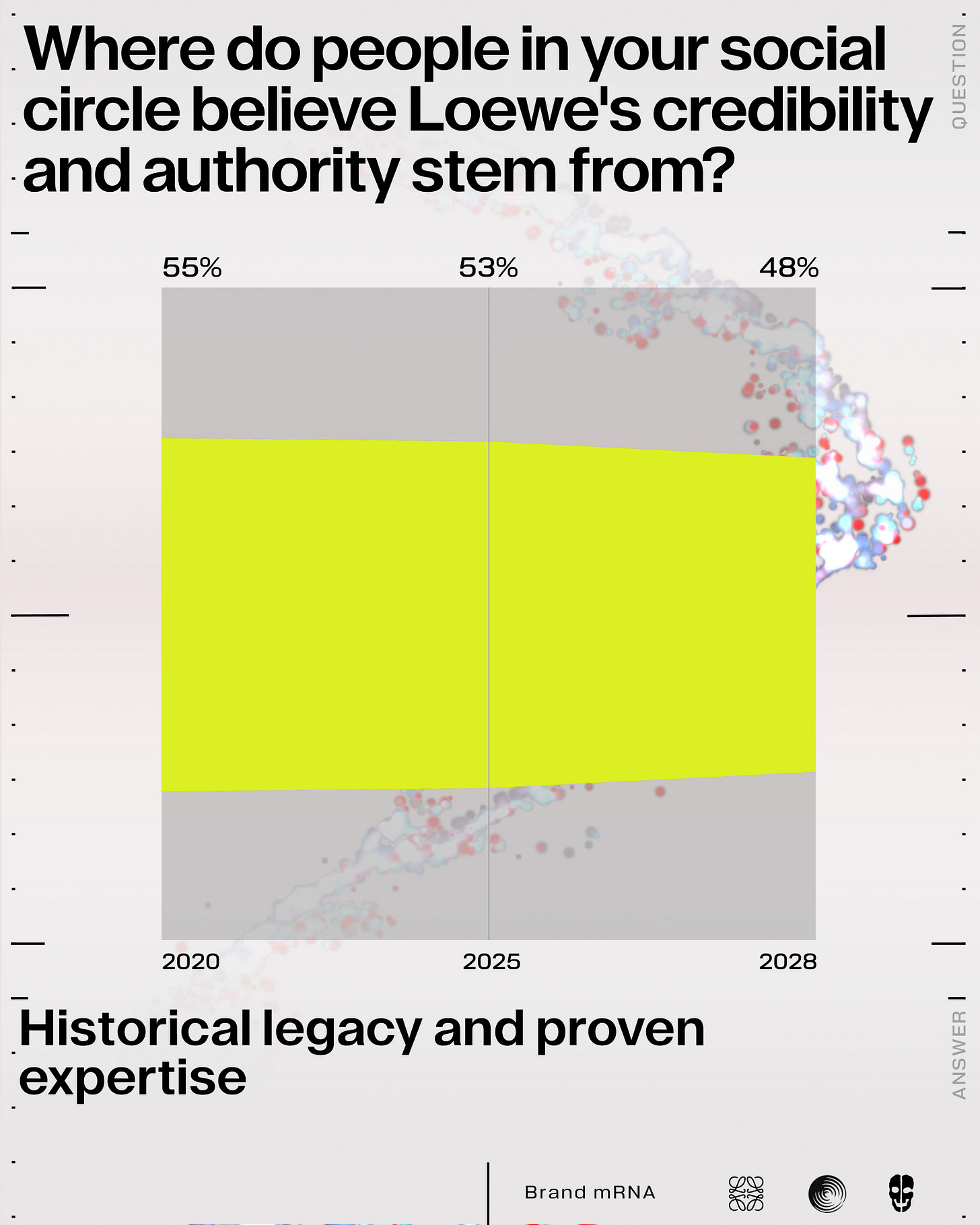

When asked where their social circles believe Loewe’s credibility and authority will come from in the future, respondents pointed to a new mix of signals:

Celebrity/influencer association and validation is expected to rise to 40%, up from 30% today and just 24% five years ago.

Technical innovation and material advancement climbs to 37%, from 33% now and 30% previously.

Cultural relevance and contemporary dialogue reaches 45%, up from 43% and 39%.

Meanwhile, historical legacy and proven expertise (long Loewe’s foundation) continues to decline: 48% in the future, down from 53% today and 54% five years ago.

In short: Loewe’s credibility is shifting from its past toward its participation in the now. Authority will be earned less through legacy and more through cultural fluency, visible innovation, and association with relevant, respected talent.

From Storyteller to Signal Listener

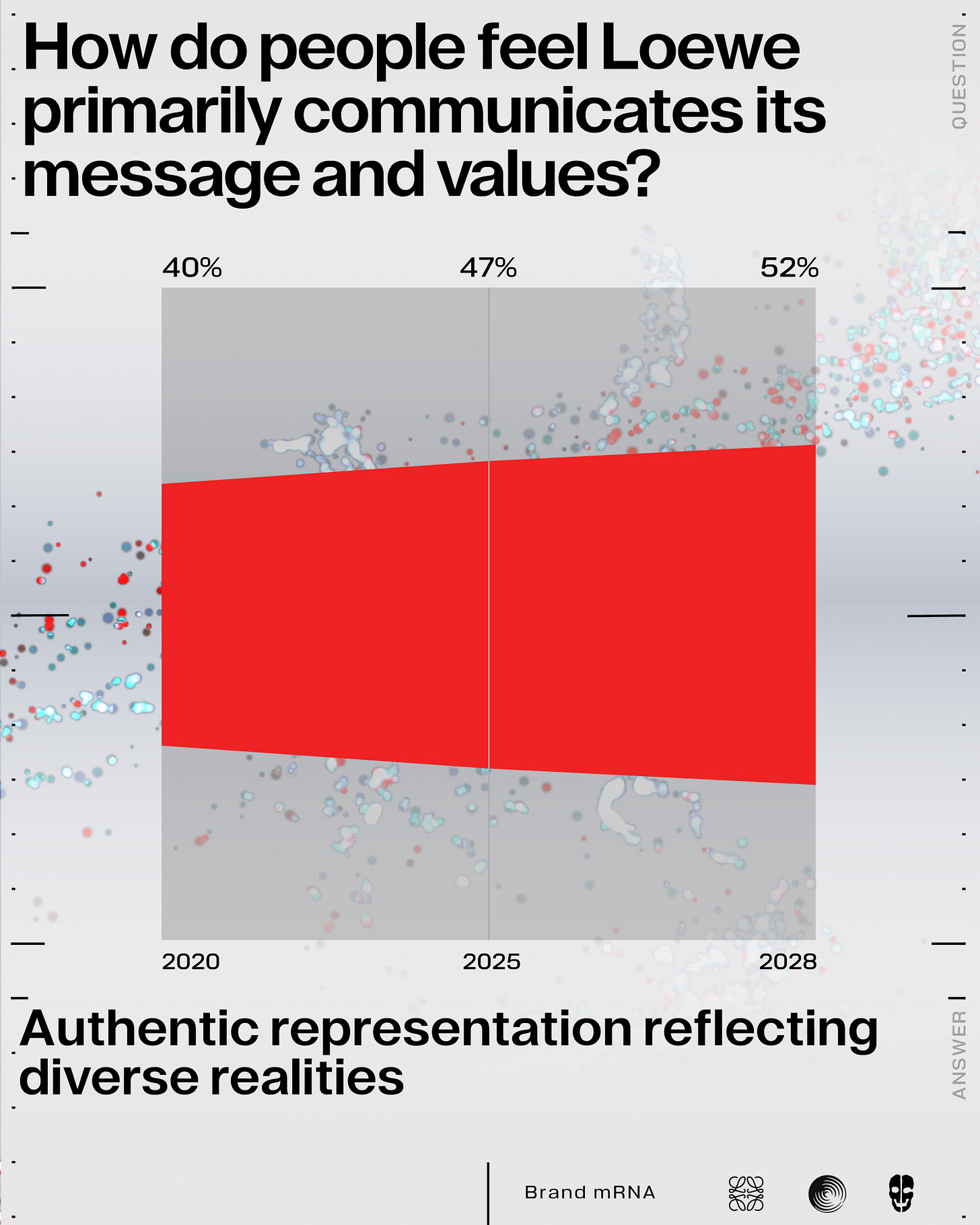

That shift in credibility also hints at something deeper: people are no longer looking for brands to define the story, they want to be in the story and help shape, redirect, and remix it.

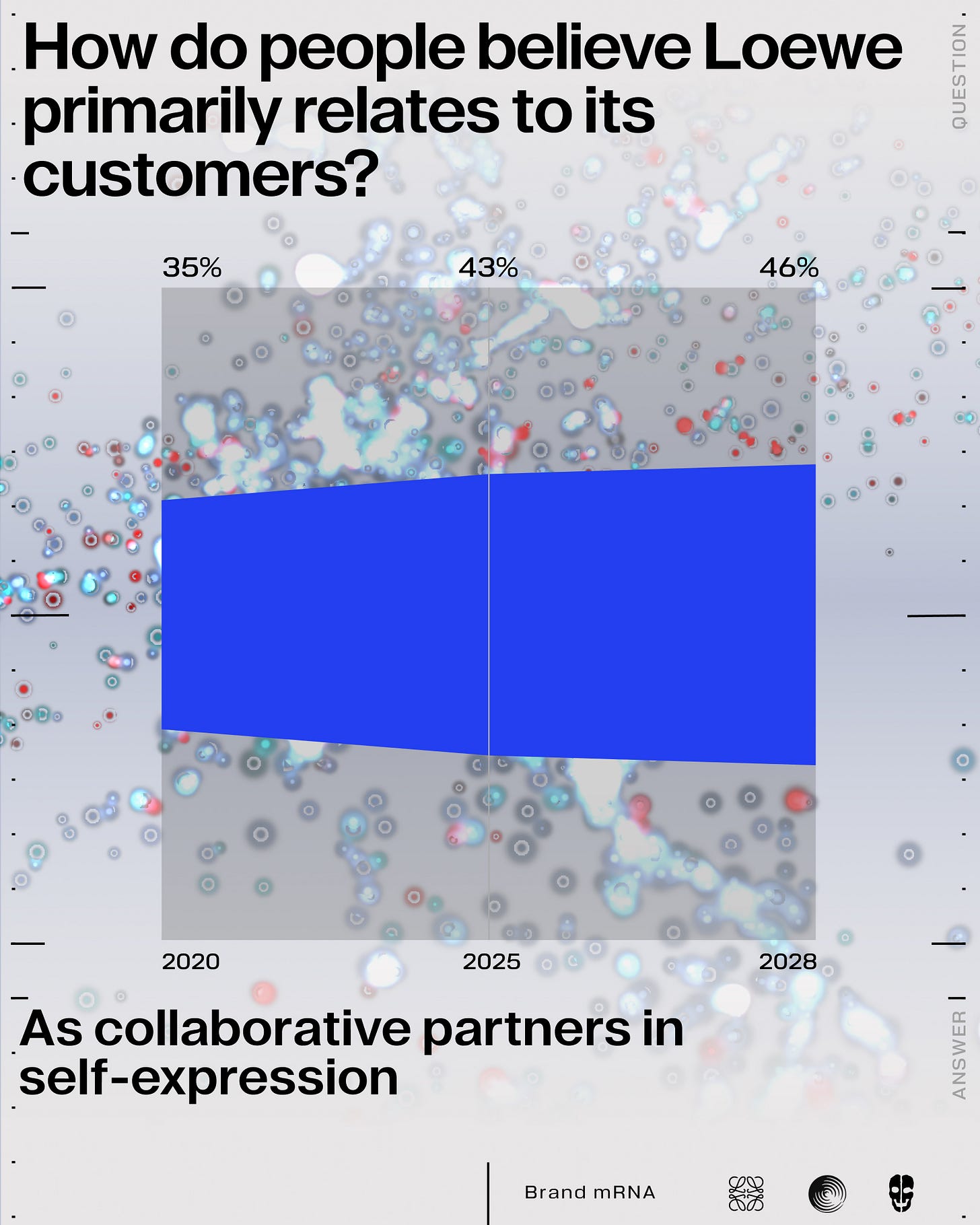

In our research, the most resonant perception of Loewe’s customer relationship wasn’t about storytelling or validation. It was collaboration. Today, 43% of respondents say people view Loewe as a partner in self-expression, up from 35% five years ago, and projected to grow to 46%. The brand isn’t expected to speak at its audience anymore, but to move with them. To build meaning together. Authority now comes from alignment, not authorship.

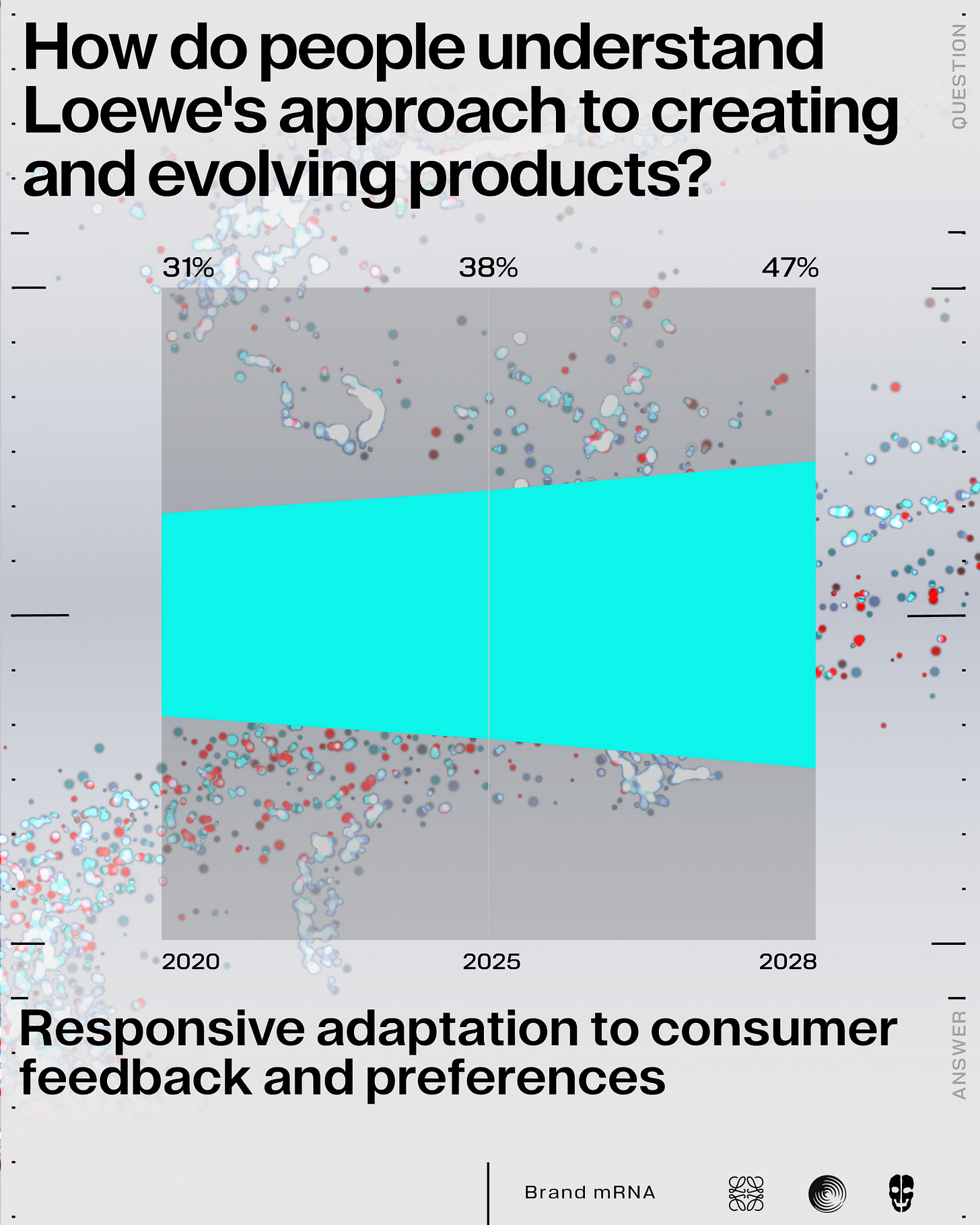

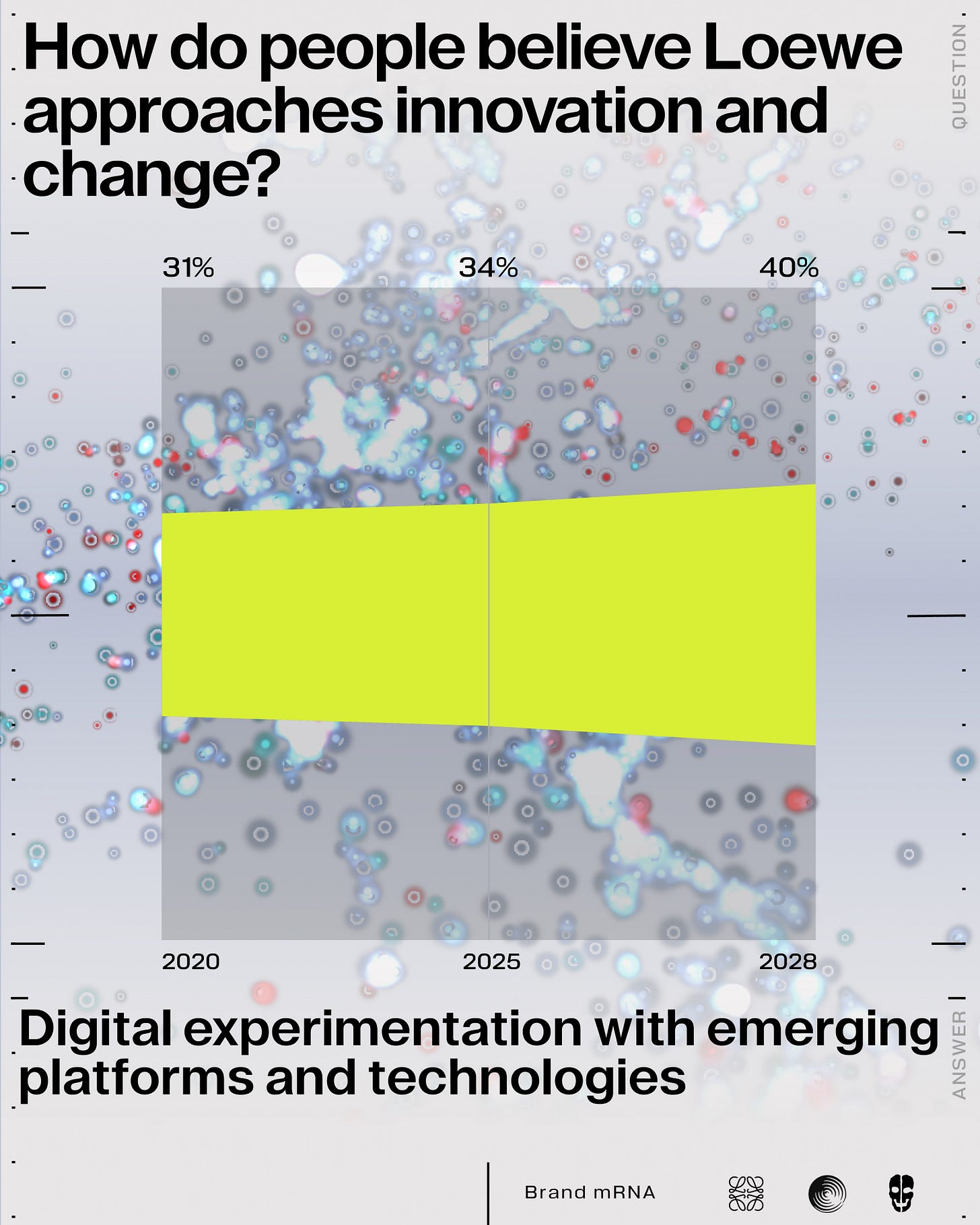

That mindset shift shows up again when we asked how people believe Loewe approaches innovation and change. The top response? Responsive adaptation to emerging consumer demands, up from 38% to 47%, and expected to climb past 50%. Reinventing archival signatures or reworking house codes isn’t enough. Relevance today means tuning into culture in real time and knowing when to move, not just how.

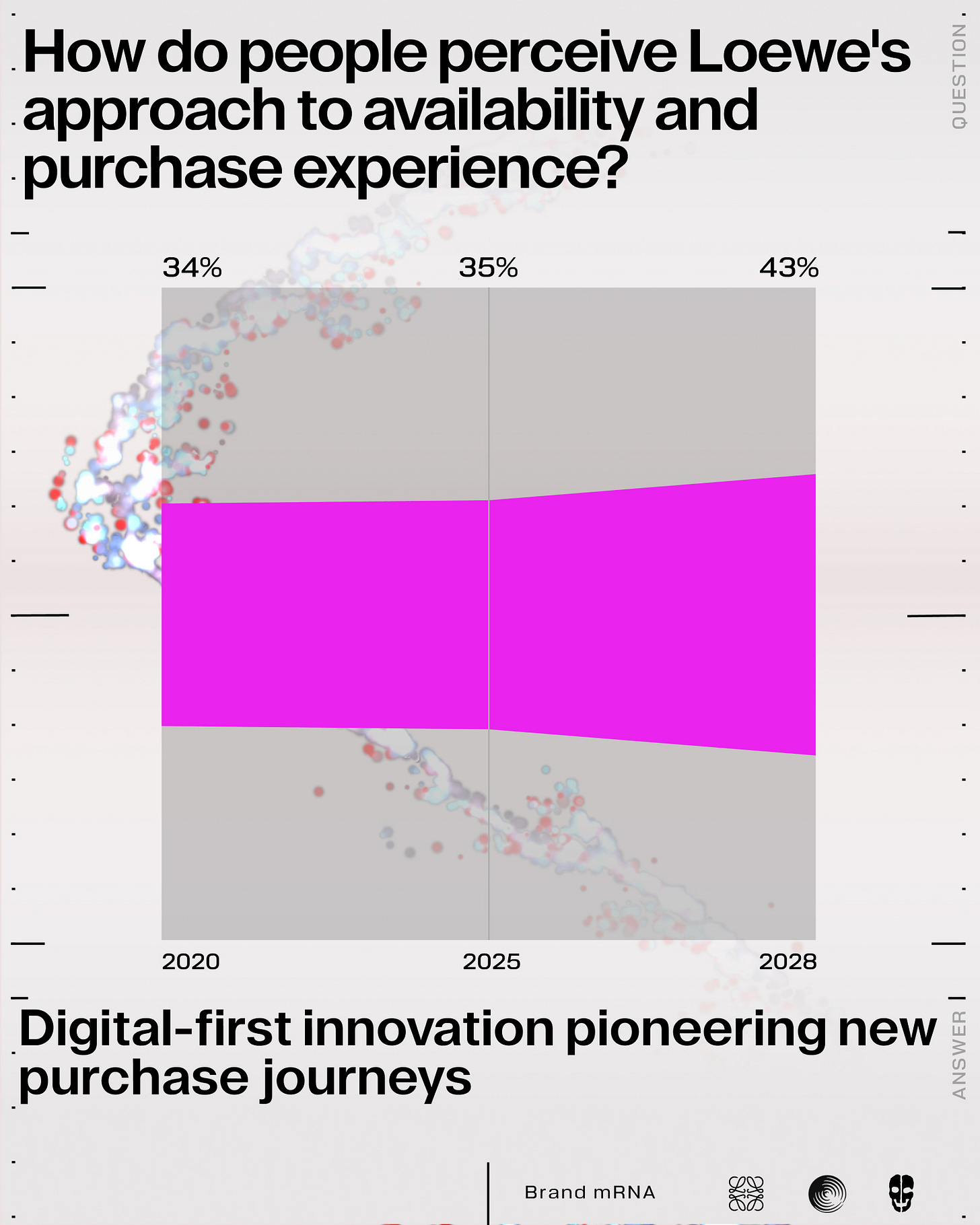

It even applies to how the brand is expected to sell. When asked about Loewe’s retail experience, the clearest signal was digital-first innovation, rising from 34% to 43%. People don’t just want convenience; they want interaction that feels alive, intelligent, intuitive. Retail as a responsive system, not a static format.

And in terms of the broader community? That’s changing too. 50% of respondents expect Loewe’s relationship with people to feel more like an exclusive membership, one built on privileges, yes, but also participation. Less about status from the outside, more about meaning from the inside. A network beyond its control at times

Altogether, these signals point to a new operating model. One that’s not built on legacy, but on listening. Loewe’s next act won’t be about tighter control, it will be about smart release. Letting go, in order to stay connected. Intercepting culture’s radio waves, not broadcasting over them.

And maybe, just maybe, that leads to something entirely new. A future where Loewe functions less like a brand and more like a cultural operating system or club: fluid, responsive, defined by the people inside it.

Just some food for thought...

I believe Loewe's success stems from their ability to reestablish 'Craft' as a house code for today's audience. The beauty of craft (as a creative platform) is its independence, and yet it remains personal to each Creative Director at Loewe. I wonder how The Schouler Boys will interpret craft.

This is excellent. It’s fascinating how Loewe has come to be seen as a guardian of heritage, especially considering how much of that perception has been shaped through TikTok trends. It’s a clear reminder that being relevant on social media doesn’t mean you have to sacrifice depth or complexity in your messaging.